Movement of Business Towards Singapore: A Safer Option in Uncertain Times

In recent years, the business landscape in Asia has been undergoing significant shifts. One of the most notable trends is the movement of businesses from Hong Kong to Singapore. Singapore has become a preeminent destination for setting up a regional headquarters and other foreign company structures to pursue business opportunities across ASEAN and Asia.

This shift has been driven by a combination of factors, including the uncertainty surrounding Hong Kong's political situation and the weakening of its economy.

As a result, many businesses are choosing to invest in Singapore, which is seen as a safer and more stable option.

The recent Q3 2023 review for commercial sales in the capital market, which, although muted due to increasing Fed interest, presents an opportunity in uncertain times.

So. if you are a business owner or investor looking to make strategic investments in commercial real estate, this is for you.

In this article, we will explore the reasons behind Singapore's rise as a business hub, the challenges faced by Hong Kong, and the potential for investors to capitalize on Singapore's growth.

The Uncertainty of Hong Kong

Hong Kong has long been a global financial hub, attracting businesses from around the world with its strategic location and business-friendly environment.

However, in recent years, the city has been plagued by political unrest and uncertainty, which has led to a decline in its attractiveness as a business destination.

The implementation of the National Security Law in 2020 In HK further raised concerns about the city's autonomy and the protection of civil liberties, leading many businesses rethink their presence in Hong Kong and consider alternative destinations.

One such destination that has been gaining significant momentum is SINGAPORE.

The Weakening of Hong Kong's Economy

In addition to the political uncertainty, Hong Kong's economy has also been facing challenges. The city's GDP growth has been slowing in recent years, and the COVID-19 pandemic has further exacerbated the situation.

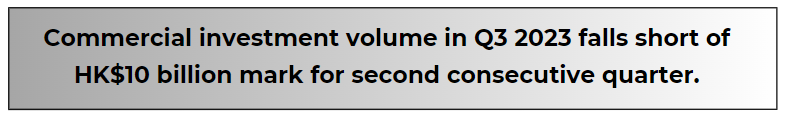

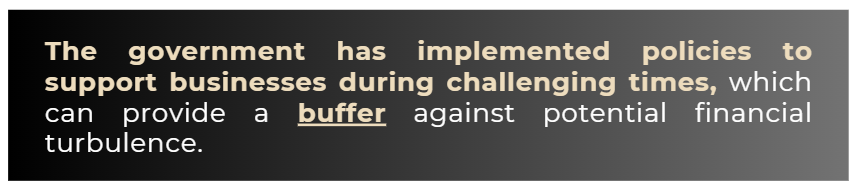

Low Investment Volume in Hong Kong Property Market:

- Total commercial investment volume in Q3 2023 was only HK$6.9 billion, failing to breach the HK$10 billion mark for the second consecutive quarter.

- Redevelopment projects and end-user purchases accounted for the majority of investment volume.

Chinese Capital Takes up 32% of Investment in Q3:

- Chinese capital deployed HK$2.2 billion or 32% of total investment in Q3 2023, similar to the previous quarter.

- Seasoned investors remain cautious while end-users seek discounted assets.

The Rise of Singapore

Singapore's rise as a business destination can be attributed to its stable political environment, robust legal system, and strategic location in Southeast Asia. These factors have attracted businesses and investors seeking a safe and reliable base for their operations.

ANZ Bank CEO, Shayne Elliott, has even stated that Singapore is "winning out over Hong Kong".

Singapore's Proactive Economic Development Strategy Boosts Real Estate Investment in Q3 2023

Additionally, the Singaporean government's proactive approach to economic development, including the recent Government Land Sales (GLS) program, has further bolstered the country's attractiveness to investors.

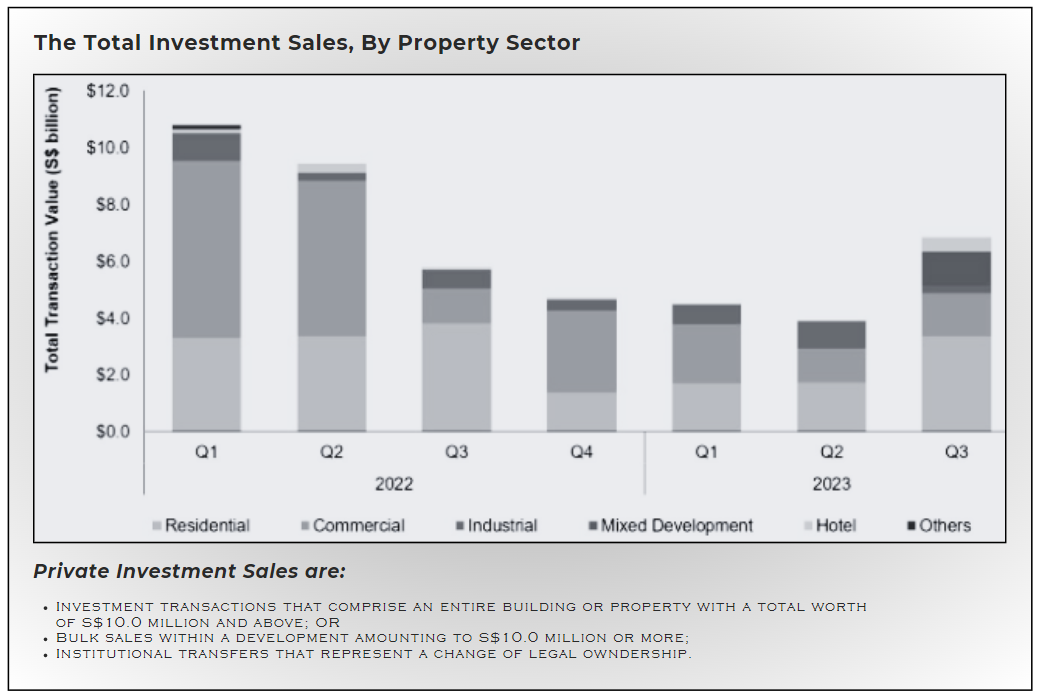

In Q3 2023, Singapore's real estate investment rose for the first time in nearly two years, with deal volume reaching S$6.9 billion. This rebound was driven by Chinese buyers and the GLS program, which offered prime land parcels for development.

5 Factors that Make Singapore an Attractive Option for Investors

Singapore's ascendancy as a business and investment destination is no accident. This small island nation has consistently ranked high in global competitiveness and ease of doing business.

Let's explore the 5 factors that make Singapore an attractive option for investors:

- Political Stability

- Economic Resilience

- Pro-Business Policies

- Connectivity

- Quality of Life

The Opportunity Amid Uncertainty

The Fed's Cautious Footing

The Federal Reserve's cautious approach to interest rates has played a role in driving businesses and investors towards Singapore. The Fed's recent minutes show that policymakers are on cautious footing due to the uncertainty and growth risks in the global economy.

A Safer Option in Uncertain Times

While the Fed's cautious stance may have an impact on global financial markets, it's important to note that the situation is significantly different in Singapore.

Singapore has managed to maintain an environment of relatively stable interest rates.

This stability not only shields the local market from the abrupt fluctuations observed in the US but also ensures that businesses operating in Singapore can count on predictable financing costs.

While the growth was somewhat muted due to increasing Fed interest, it still presented an opportunity for investors in uncertain times.

Q3 2023 Review for Commercial Sales in Singapore

In Q3 2023, Singapore's commercial property market showed signs of recovery, with total deals amounting to S$1.5 billion, largely due to the sale of Changi City Point and Far East Shopping Centre, representing a 27.4% quarter-on-quarter increase and a 23.3% year-on-year increase.

- Singapore's economy picked up speed in Q3 2023, with a 0.7% year-on-year lift in GDP, beating expectations for a 0.2% gain.

- Banks, including DBS, OCBC, and UOB, led the net institutional fund inflow to Singapore stocks in Q3 2023.

- The Government Land Sales (GLS) program and Chinese buyers played a significant role in driving the recovery of Singapore's real estate market in Q3 2023.

- The growth in the market, although affected by increasing Fed interest, still provided an opportunity for investors in uncertain times.

In the face of global uncertainty, there is a premium on safety and stability.

Choosing Singapore as your investment destination is the key to securing your financial future.

Don't miss out on the unparalleled benefits that investing in this thriving city-state offers.

But remember, opportunities do not last forever. The time to act is now. Delaying your decision to invest in Singapore may lead to missed chances for growth, financial stability, and unmatched returns on your investments.

As a realtor who has seen the rise and fall of markets, I can confidently say that Singapore is not just a safer option; it is the best option in these uncertain times. Make your move today and secure your place in the future of business success.

Don't let uncertainty hold you back – invest in Singapore and watch your business flourish.

Contact us now!