|

District |

Area / Development Type |

Average Price PSF (Resale) |

Average Price PSF (New Launch) |

Notes |

|---|---|---|---|---|

|

D15 |

Katong / Amber Road |

$2,250-$2,600 |

$2,800-$3,200 |

Prestige, conservation shophouses, and lifestyle appeal drive a premium |

|

D15 |

Tanjong Rhu / Meyer Road |

$2,300-$2,700 |

$2,900-$3,300 |

Waterfront exclusivity + strong rental demand |

|

D16 |

Bayshore (Current resale condos like Costa Del Sol, Bayshore Park) |

$1550-$1,850 |

$2,200–$2,600 |

Significant value opportunity compared to D15 |

The Bayshore Transformation

The Bayshore Government Land Sale (GLS) site was awarded at a record-breaking price of around $1,399 psf ppr, courtesy of a joint venture between SingHaiyi Group and Haiyi Holdings, setting a new benchmark for District 16. This surpassed the previous OCR benchmark by a healthy margin.

Developers don’t pay that kind of money unless they see something big coming.

And here’s the thing: Bayshore’s transformation isn’t happening in isolation. We’re looking at a triple boost.

1. The brand-new operational Bayshore MRT station on the Thomson-East Coast Line (TEL), opened in June 2024,

2. A comprehensive urban renewal plan by the Urban Redevelopment Authority (URA), and

3. Its prime natural advantage of being steps away from the East Coast waterfront.

Looking at nearby precincts like Katong and Tanjong Rhu, which have enjoyed rapid price appreciation over the past decade, Bayshore is now poised for a similar upward trajectory—right now, investors have an early opportunity.

To give you a clearer picture:

- Resale prices for older Bayshore condos like Costa Del Sol and Bayshore Park currently range between $1,400 and $1,650 psf in 2025.

- Meanwhile, new launches in Katong and Tanjong Rhu trade much higher, between $2,600 and $3,200 psf.

- Upcoming new launches in Bayshore, following the GLS, are estimated to debut around $2,200 to $2,700 psf.

Source: URA

Notice the gap?

Buying into Bayshore resale today means entering below $1,500 psf on average—a significant 40–60% discount compared to new launch prices in the same general area.

History tells us this kind of gap typically leads to strong capital appreciation.

Recall Tanjong Rhu’s early 2000s transformation: when new launches priced above $1,800 psf came in, nearby resale condos priced around $1,200–$1,300 psf surged 30–40% over the next few years.

Why Bayshore’s Transformation Matters to Investors

What’s unfolding here is a rare confluence of urban planning, infrastructure, and lifestyle demand that we don’t see often in Singapore.

The Urban Redevelopment Authority (URA) has already earmarked Bayshore as a “new waterfront residential precinct”, comparable in ambition to how Tanjong Rhu and Katong were repositioned in the past.

1. MRT Connectivity—From “Far East” to City’s Doorstep

Bayshore is no longer “the end edge" of the East Coast.

With the operational Bayshore MRT station on TEL, it is among the most connected neighborhoods in the east.Travel times now stand at approximately:

- 15 minutes to Orchard.

- 20 minutes to Marina Bay.

- with direct links to Changi Airport, Pasir Ris, and the western region via the future Cross Island Line (CRL) interchange planned at Bayshore.

- Properties near TEL stations like Great World and Orchard Boulevard have already seen 8–12% appreciation since their openings in 2022–2023.

- Resale condos in Katong (Amber and Meyer areas) now trade 20–25% higher psf compared to similar-age condos further inland.

Do you see where I’m going? When Bayshore MRT is ready, we can reasonably expect a similar uplift of 15–20% in prices over the next 3–5 years.

2. Government’s URA Master Plan = Stability + Growth

URA has designated Bayshore as a “new waterfront residential precinct” comparable in ambition to Katong and Tanjong Rhu’s past rejuvenations. The precinct is slated for:

- 12,500 new homes (both public and private).

- A new waterfront town centre with integrated retail and lifestyle amenities.

- Car-lite town planning featuring wide pedestrian boulevards, cycle paths, and seamless connections to East Coast Park.

When the government invests billions into urban planning, it ensures that demand doesn’t just come from investors like you — it also comes from families, upgraders, and tenants who actually want to live there. That’s your long-term safety net.

3. Lifestyle + Tenant Attraction

If you’re buying to rent out, Bayshore is a future tenant hotspot. Why?

- Proximity to Changi Business Park, Changi Airport, and the new Aviation Hub — tenants who work in aviation, logistics, and tech already dominate East Coast rentals.

- Waterfront living without Sentosa premiums — while Sentosa Cove rents average $7–8 psf, East Coast hovers at $4.50–5.50 psf, attracting expats who want lifestyle but also value.

- Education demand — Tanah Merah and Bedok South areas are near international schools like One World International and United World College (UWC), a strong pull for families.

How Bayshore Stacks Up Against Katong & Tanjong Rhu

Let me be honest with you — Bayshore today is a “work in progress.” Katong and Tanjong Rhu? They’re already established East Coast darlings. They’ve got the buzz, the reputation, and the price tags to match.

But that’s exactly why Bayshore is worth paying attention to — it’s still playing catch-up, and catch-up phases are when savvy investors lock in value.

Price and Lifestyle Comparison (September 2025)

Here’s a quick side-by-side look at how prices are moving right now:

(Source: URA caveats, developer GLS bids, market transactions, 2025)

That means, if you buy into Bayshore early, you’re not just buying a home or an investment — you’re buying into East Coast at a discount.

Lifestyle & Connectivity Comparison

- Katong → Already matured with malls (i12 Katong, Parkway Parade), culture, and strong schools. But traffic is tight, and supply is more limited.

- Tanjong Rhu → Waterfront exclusivity, great for professionals and expats, but it’s pricier and already saturated with luxury stock.

- Bayshore → New MRT (Bayshore & Bedok South stations on Thomson-East Coast Line), integrated precinct with retail and community hubs, and a fresh masterplan that will turn it into the next big lifestyle spot.

Rental Demand & Exit Strategies

Who’s Actually Renting in Bayshore?

|

Tenant Profile |

What They Want |

Why Bayshore Appeals |

|---|---|---|

|

Expatriates seeking East Coast lifestyle |

Big balconies, sea views, outdoor lifestyle (cycling, jogging, kite-surfing). |

East Coast Park lifestyle without Katong/Tanjong Rhu prices. Offers that “holiday feel” daily. |

|

Professionals in Changi Business Park & Changi Airport |

Shorter commutes, convenience, modern condos. |

Banks (Citibank, DBS, Standard Chartered) & aviation/logistics staff currently rent in Tanah Merah/Simei. Bayshore MRT will pull them closer to the coast. |

|

Local upgraders renting temporarily |

Lifestyle perks while waiting for new BTO/condo to TOP (2–3 years). |

Bayshore offers “affordable gateway” into East Coast living — aspirational but within reach. |

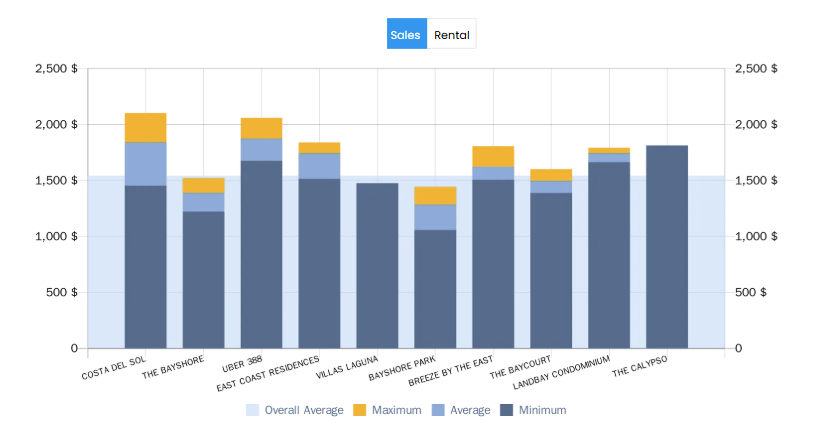

Updated Rental Numbers (Sept 2025):

- Older 3-bedroom condos in Bayshore: $4,800 – $5,500/month

- Newer units (Seaside Residences as benchmark): $6,200 – $7,500/month

- Average yields today in Bayshore: 3.4% – 3.8%

- Projected yields post-Bayshore MRT and GLS launch: 4.2% – 4.6%

For context:

- Katong/Joo Chiat 3-bedders now average $7,800/month

- Tanjong Rhu 3-bedders average $8,500/month

You should notice. Bayshore is still discounted.

Why Rental Demand Will Jump

Two triggers are about to reset the rental scene here:

1. The Bayshore MRT (expected 2026 opening):

- Direct connection to the Thomson-East Coast Line (TEL).

- Tenants love “walk-to-MRT convenience” — you’ll see premiums of $400–$600 more in monthly rent compared to non-MRT condos.

2. New GLS launches (Bayshore precinct):

- Record bid prices already signal developers will sell new units at $2,400–$2,600 psf average.

- Tenants of these new condos will pay premium rents.

- Older Bayshore condos nearby will ride this wave and reset their rental benchmarks upwards.

How to Plan Your Exit Smartly

Short to Mid-Term Exit (2029):

- If you’re buying now in older Bayshore condos, your best play is to hold until after Bayshore MRT officially opens and subsequent projects launch at record prices.

- That’s when buyer psychology shifts. Families and investors will finally “see” the lifestyle and pay more.

- You’ll likely enjoy capital gains of 18%–25% (5years) within this window.

Long-Term Hold (2030 and beyond):

- For those buying new GLS launches or younger projects like Seaside Residences, your best play is to hold.

- By 2030, East Coast will be fully transformed with Bayshore, Katong Park, and Tanjong Rhu all linked into one lifestyle belt.

- These will become prime family-friendly waterfront districts, like how Tanjong Rhu evolved in the 2000s.

|

Scenario |

But-in Price (2025) |

Rental Yield Today |

Expected Yield Post-MRT |

Exit Strategy |

Projected Gain |

|---|---|---|---|---|---|

|

Older Bayshore Condo (e.g., Bayshore Park) |

$1,350 psf |

3.5% |

4.3% |

Sell 2027-2028 |

20%+ |

|

Mid-age Condo (e.g., Costa Del Sol) |

$1,750 psf |

3.8% |

4.5% |

Hold 2029+ |

25-30% |

|

New GLS Launch (2025/26) |

$2,500 psf (est.) |

3.2% |

3.8% |

Hold long-term (2030+) |

35-40% |

I’ve been in this market long enough to know that not every “transformation” story plays out as promised. Some fizzle, some stall, and some simply don’t deliver the returns investors hope for. But Bayshore? This one feels different.

The fundamentals are real and already in motion.

- The MRT stations— they’re rising from the ground right now.

- The GLS record sale — it’s the government sending a clear signal about confidence in Bayshore’s future.

- The East Coast lifestyle— it’s been a proven magnet for tenants and buyers for decades.

The question is not whether Bayshore will transform. The question is whether you’ll position yourself early enough to benefit from it.

Let’s Get You Into Bayshore

I’m here to make sure you don’t miss what could be the next big story in "East Coast Plan". Let me help you secure the right entry point.

Message me now!